The Importance of Adequate Coverage Limits in Financial Insurance

Insurance is a crucial aspect of financial planning, providing individuals and businesses with a safety net against unforeseen events and potential financial losses. Whether it's health, property, life, or business insurance, the coverage limits play a pivotal role in determining the level of protection policyholders receive. Adequate coverage limits are essential in ensuring that policyholders can effectively recover from incidents and maintain financial stability during challenging times.

Understanding Coverage Limits

Coverage limits refer to the maximum amount an insurance policy will pay out in the event of a claim. It is the boundary that sets the cap on the benefits received by the policyholder. These limits can vary significantly based on the type of insurance and the specific policy terms. It is crucial for individuals and businesses to carefully assess their needs and choose coverage limits that align with their potential risks.

Safeguarding Against Catastrophic Losses

One of the primary reasons for having adequate coverage limits is to safeguard against catastrophic losses. Insurance policies are designed to protect against unexpected events that could lead to significant financial burdens. For example, in health insurance, high coverage limits ensure that policyholders are not burdened with exorbitant medical expenses in case of severe illnesses or accidents.

Similarly, property insurance with sufficient coverage limits can help homeowners and businesses rebuild or repair their assets after a major disaster like a fire, earthquake, or flood. Without adequate coverage, policyholders may be left with substantial out-of-pocket expenses or, in worst cases, may not be able to recover completely from the loss.

Mitigating Liability Risks

Liability insurance is essential for businesses and individuals alike. It provides protection in case they are held legally responsible for causing harm to others or damaging someone else's property. In such situations, the coverage limits determine the maximum amount the insurance company will pay for legal fees, settlements, or judgments.

Having adequate liability coverage is vital, as legal claims and lawsuits can be financially crippling. If the coverage limits are too low, the policyholder may have to cover the remaining expenses out of pocket, leading to severe financial strain and potential bankruptcy.

Ensuring Continuity of Business Operations

For businesses, adequate insurance coverage is critical for ensuring the continuity of operations. Business insurance policies, such as commercial property insurance and business interruption insurance, protect against various risks that could interrupt normal business activities.

In the event of a disaster, having sufficient coverage limits allows businesses to repair or replace damaged property, cover ongoing expenses, and potentially recover lost income during the interruption period. This helps businesses get back on their feet quickly and minimizes the impact of the event on their financial stability.

Peace of Mind for Policyholders

Having insurance coverage with adequate limits provides peace of mind for policyholders. Knowing that they are adequately protected against unforeseen events and potential financial losses allows individuals and businesses to focus on their daily activities and long-term goals without constant worry about financial risks.

Reviewing and Updating Coverage Limits

As circumstances change over time, it is crucial to regularly review insurance policies and update coverage limits accordingly. Major life events, such as purchasing a new property, starting a business, or having significant changes in income, may require adjustments to insurance coverage to ensure adequate protection.

Consulting with insurance professionals and financial advisors can help policyholders make informed decisions about their coverage needs and choose appropriate coverage limits that align with their current and future requirements.

Adequate coverage limits are the backbone of financial insurance. They serve as the foundation upon which individuals and businesses build their financial security. Having the right coverage limits ensures that policyholders can effectively recover from losses, mitigate liability risks, and maintain their financial well-being during challenging times. Regularly reviewing and updating coverage limits is essential to ensure that insurance policies continue to provide meaningful protection in the face of evolving circumstances. Ultimately, adequate coverage limits provide the peace of mind that enables policyholders to navigate life's uncertainties with confidence.

Financial insurance plays a vital role in mitigating risks and protecting individuals and businesses from unexpected financial losses. From health and life insurance to property and liability coverage, there are various insurance options available to cater to diverse needs. However, choosing the right insurance plan requires a careful assessment of its cost-effectiveness, ensuring that the benefits provided justify the premiums paid. This article explores the key factors to consider when assessing the cost-effectiveness of financial insurance options.

Understanding Insurance Premiums and Coverage

Insurance premiums are the regular payments policyholders make to maintain their insurance coverage. The amount of the premium is determined by various factors, including the type of insurance, coverage limits, deductible (the amount the policyholder must pay before the insurance kicks in), and the risk profile of the insured individual or business.

Coverage, on the other hand, refers to the extent of protection provided by the insurance policy. It outlines what events or situations are covered and to what extent the insurer will bear the financial burden in case of a claim.

Comparing Premiums and Potential Risks

Assessing the cost-effectiveness of an insurance option begins with comparing the premiums to the potential risks the policyholder faces. A higher premium doesn't necessarily mean better coverage, nor does a lower premium always indicate inadequate protection. It's essential to strike a balance between affordable premiums and sufficient coverage that aligns with the individual's or business's risk exposure.

Policyholders should evaluate the likelihood of facing different risks and their potential financial impact. For example, a young and healthy individual may opt for a health insurance plan with a higher deductible and lower premiums if they have no pre-existing conditions or major health concerns. On the other hand, a person with a chronic medical condition may prefer a plan with higher premiums but more comprehensive coverage to manage potential healthcare costs better.

Analyzing the Cost-Benefit Ratio

The cost-benefit ratio involves analyzing the value of the insurance coverage relative to the total premium paid over time. Policyholders should consider both tangible and intangible benefits when evaluating the cost-effectiveness of their insurance options.

Tangible benefits are the direct financial reimbursements received from the insurance company in case of a claim. For example, if a policyholder's property is damaged in a covered event, such as a fire, the insurance company will pay for the repairs or replacement, reducing the out-of-pocket expenses.

Intangible benefits include peace of mind, financial security, and the ability to focus on other priorities without constant worry about potential risks. While intangible benefits are not directly quantifiable, they are essential aspects of insurance that contribute to its overall cost-effectiveness.

Calculating the Total Cost of Ownership

The total cost of ownership (TCO) takes into account all costs associated with an insurance policy over its lifespan. It includes not only the premiums paid but also any deductibles, co-pays, and out-of-pocket expenses incurred when filing claims. Additionally, TCO considers any potential cost savings resulting from insurance coverage.

By calculating the TCO, policyholders can make more informed decisions about the long-term affordability and value of different insurance options. This analysis enables them to identify potential cost-saving measures or seek insurance plans that provide better value for their specific needs.

Assessing Policy Flexibility and Customization

The cost-effectiveness of financial insurance options can also be influenced by the policy's flexibility and customization features. Some insurance providers offer policies that allow policyholders to tailor coverage to suit their unique circumstances. For instance, a business might benefit from a commercial insurance policy that can be adjusted as the company grows or diversifies its operations.

Customizable insurance plans can help individuals and businesses avoid paying for coverage they don't need while ensuring they have adequate protection in areas where their risks are higher.

Seeking Professional Advice

Choosing the most cost-effective insurance option can be a complex task, especially when considering various risk factors and policy features. As such, seeking advice from insurance professionals and financial advisors is highly recommended. These experts can help analyze individual or business-specific risks, provide insights into available insurance options, and guide policyholders toward the most suitable and cost-effective coverage.

Assessing the cost-effectiveness of financial insurance options involves a careful evaluation of premiums, coverage, potential risks, and long-term affordability. It's essential for policyholders to strike a balance between affordable premiums and adequate coverage that aligns with their risk exposure and financial capabilities. By analyzing the cost-benefit ratio and calculating the total cost of ownership, individuals and businesses can make well-informed decisions to protect their financial well-being effectively. Seeking professional advice further enhances the decision-making process, ensuring that policyholders obtain the most suitable and cost-effective insurance coverage for their unique needs.

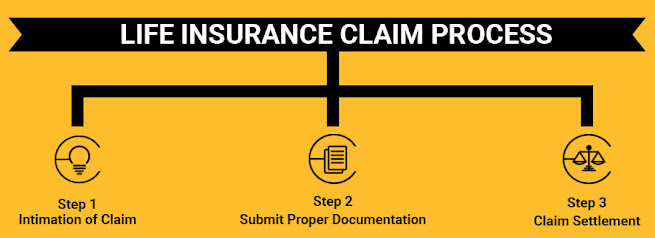

Navigating the Claims Process in Financial Insurance Policies

Making an insurance claim is a crucial step in utilizing the benefits of financial insurance policies. Whether it's health, property, life, or liability insurance, the claims process is designed to provide policyholders with the necessary support and financial assistance during challenging times. However, navigating the claims process can be complex and overwhelming if one is not familiar with the procedures involved. This article aims to guide individuals and businesses through the essential steps of navigating the claims process in financial insurance policies.

Step 1: Understand Your Policy Coverage

Before a claim can be filed, it is essential to have a clear understanding of the insurance policy's coverage. Policyholders should review their policy documents to know what events or situations are covered and the specific terms and conditions of the coverage. This includes knowing the coverage limits, deductible (if applicable), and any exclusions that may apply.

Having a thorough grasp of the policy's coverage ensures that the claim is filed correctly and reduces the risk of misunderstandings or claim denials due to policy-related discrepancies.

Step 2: Notify the Insurance Company

Once an insured event occurs, policyholders should promptly notify their insurance company about the incident that led to the claim. Most insurance providers have specific timeframes within which claims must be reported, so it is crucial to act swiftly. Delaying the notification may lead to complications during the claims process or even potential claim denials.

In case of emergencies, such as a major accident or property damage, it is essential to inform the insurance company as soon as possible, even before seeking immediate medical attention or making repairs. Insurance companies may provide guidance on the necessary steps to take after an insured event occurs.

Step 3: Gather Documentation and Evidence

Supporting documentation is a vital part of the claims process. Policyholders should gather all relevant documents and evidence to substantiate their claim. This may include medical reports, police reports, photographs of the damage or incident, receipts for expenses, and any other documentation required by the insurance company.

Thorough and accurate documentation helps the insurance company assess the claim more efficiently and reduces the likelihood of disputes or delays.

Step 4: File the Claim

To initiate the claims process officially, policyholders need to submit a claim form to their insurance provider. This form can usually be obtained from the insurance company's website or customer service department. Some insurers also offer the option to file claims online, making the process more convenient.

When filling out the claim form, it is crucial to provide all relevant and accurate information, including details of the incident, the extent of the damage or loss, and the supporting documentation. Any discrepancies or incomplete information may lead to delays in processing the claim.

Step 5: Cooperate with the Claims Adjuster

After the claim is filed, the insurance company may assign a claims adjuster to assess the validity of the claim and determine the appropriate compensation. The claims adjuster may contact the policyholder to gather additional information or schedule an inspection of the damaged property.

Policyholders should cooperate fully with the claims adjuster, providing any necessary information or access to the property as required. Being transparent and responsive during this process can help expedite the evaluation and resolution of the claim.

Step 6: Review the Claim Settlement

Once the claims adjuster completes the evaluation, the insurance company will provide a claim settlement offer. Policyholders should carefully review the settlement to ensure that it aligns with the terms of their policy and adequately covers the damages or losses incurred.

If the settlement offer is satisfactory, the policyholder can accept it, and the insurance company will proceed with the payment. However, if there are concerns or discrepancies in the settlement offer, the policyholder can discuss them with the claims adjuster or the insurance company's customer service department.

Step 7: Appeal or Dispute Resolution (if necessary)

In some cases, disputes may arise between the policyholder and the insurance company regarding the claim settlement. If the policyholder believes that the insurance company has not handled the claim appropriately or has wrongly denied the claim, they have the right to appeal the decision.

The appeals process typically involves providing additional information or evidence to support the claim. If the appeal is still not resolved satisfactorily, policyholders may seek dispute resolution services provided by the insurance company or relevant regulatory authorities.

Navigating the claims process in financial insurance policies requires a clear understanding of policy coverage, prompt notification of the insured event, thorough documentation, and cooperation with the insurance company's claims adjuster. By following these essential steps, policyholders can increase the chances of a smooth and successful claims experience. In case of any uncertainties or disputes during the process, seeking guidance from insurance professionals or customer service representatives can be beneficial in resolving issues and ensuring fair claim settlements. Remember, financial insurance is there to provide support when it is needed most, and a well-handled claims process is key to realizing the full benefits of insurance coverage.

Evaluating the Long-Term Benefits of Financial Insurance Investments

Financial insurance investments, such as annuities and life insurance policies with cash value components, offer individuals an opportunity to secure their financial future and build a stable financial foundation. While these insurance-based investment products may come with certain complexities and considerations, they can provide significant long-term benefits. This article explores the key aspects to evaluate when considering the long-term advantages of financial insurance investments.

1. Wealth Accumulation and Protection

One of the primary long-term benefits of financial insurance investments is the potential for wealth accumulation and protection. For instance, permanent life insurance policies, such as whole life or universal life, often come with a cash value component that grows over time. As policyholders continue to pay premiums, the cash value accumulates and can be accessed in the form of a tax-advantaged savings component.

This accumulated cash value can serve as a financial safety net, providing policyholders with the ability to borrow against it or withdraw funds to meet unexpected expenses or other financial goals. Moreover, the death benefit offered by life insurance policies ensures that loved ones are financially protected in the event of the policyholder's death, providing an added layer of security for the family's financial future.

2. Tax Advantages

Many financial insurance investments offer tax advantages that can contribute significantly to long-term financial planning. For instance, the growth of the cash value in life insurance policies is generally tax-deferred, meaning that policyholders do not pay taxes on the investment gains until they withdraw the funds. This can be advantageous, especially for individuals looking to build tax-efficient retirement savings.

Additionally, some insurance-based investment products, like annuities, offer tax-deferred growth, enabling individuals to accumulate wealth without immediate tax liabilities. When utilized as part of a comprehensive financial strategy, these tax advantages can help optimize overall tax efficiency.

3. Guaranteed Income and Retirement Planning

Certain financial insurance investments, particularly annuities, can provide a guaranteed stream of income during retirement. Annuities offer the option to convert a lump sum of money into regular income payments for a specific period or for the lifetime of the annuitant. This feature ensures that retirees have a stable income source to cover living expenses and maintain financial security throughout their retirement years.

Annuities can act as a pension-like income stream, complementing other sources of retirement income, such as Social Security and traditional retirement accounts. The certainty of guaranteed income can provide peace of mind and help individuals plan for a comfortable retirement.

4. Estate Planning and Legacy Creation

Financial insurance investments play a crucial role in estate planning and legacy creation. For high-net-worth individuals, life insurance policies can be utilized as an estate planning tool to create liquidity and provide for the next generation. The death benefit from life insurance can help beneficiaries cover estate taxes, pay off debts, or distribute assets according to the policyholder's wishes.

Additionally, annuities with death benefit options can ensure that beneficiaries receive a predetermined amount, protecting the financial well-being of loved ones after the annuitant's passing.

5. Diversification and Risk Management

Including financial insurance investments as part of a diversified portfolio can enhance risk management. While insurance-based products typically offer conservative growth compared to traditional investment vehicles like stocks, bonds, and mutual funds, they provide stability and can act as a buffer during market downturns.

By incorporating insurance-based products into a well-rounded investment strategy, individuals can reduce overall portfolio volatility and safeguard against unforeseen events.

Conclusion

Evaluating the long-term benefits of financial insurance investments involves a comprehensive understanding of their unique features and how they align with an individual's financial goals and risk tolerance. From wealth accumulation and protection to tax advantages, guaranteed income, estate planning, and risk management, financial insurance investments offer a range of advantages that can enhance overall financial security and provide for a stable and prosperous future.

As with any investment decision, seeking advice from qualified financial advisors and insurance professionals is crucial to ensure that these insurance-based products are integrated effectively into a comprehensive financial plan. Through careful evaluation and strategic planning, individuals can harness the long-term benefits of financial insurance investments to achieve their financial objectives and build a solid foundation for the years to come.

.jpg)

Post a Comment for "The Importance of Adequate Coverage Limits in Financial Insurance"